2 Growth Stocks Wall Street Might Be Sleeping On, but I'm Not

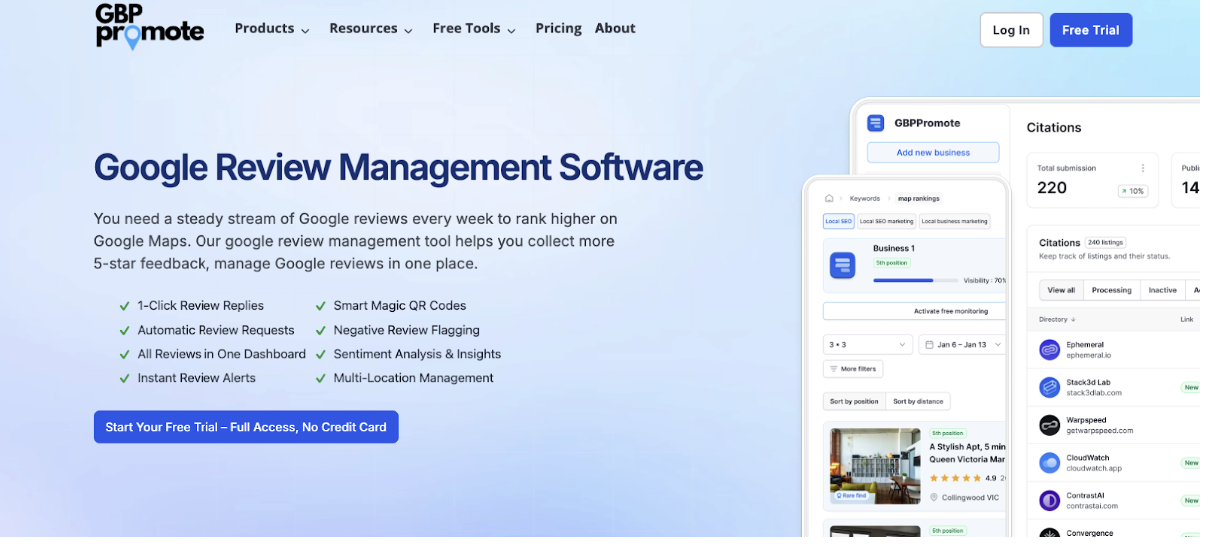

12/25/2025 07:31 AM • The article highlights Dutch Bros and Duolingo as undervalued growth stocks that Wall Street is overlooking. Dutch Bros has achieved 243% trailing revenue growth since its 2021 IPO with rapid expansion to 1,081 locations across 24 states, while trading down 26% from highs with a reasonable PEG ratio of 1.8. Duolingo posted 41% year-over-year revenue growth and 51% higher free cash flow in its latest quarter, though the stock is down 66% from record highs, now trading at attractive valuation multiples of 23.5x trailing earnings and 24x free cash flow.

BROS - Company demonstrates exceptional 243% trailing revenue growth (36% CAGR) since IPO, rapid store expansion from 503 to 1,081 locations, efficient drive-thru business model with low maintenance costs, and reasonable PEG ratio of 1.8 despite rich P/E multiples. Stock down 26% from highs presents attractive entry point.

Investing.com • Michael Foster

Investing.com • Michael Foster