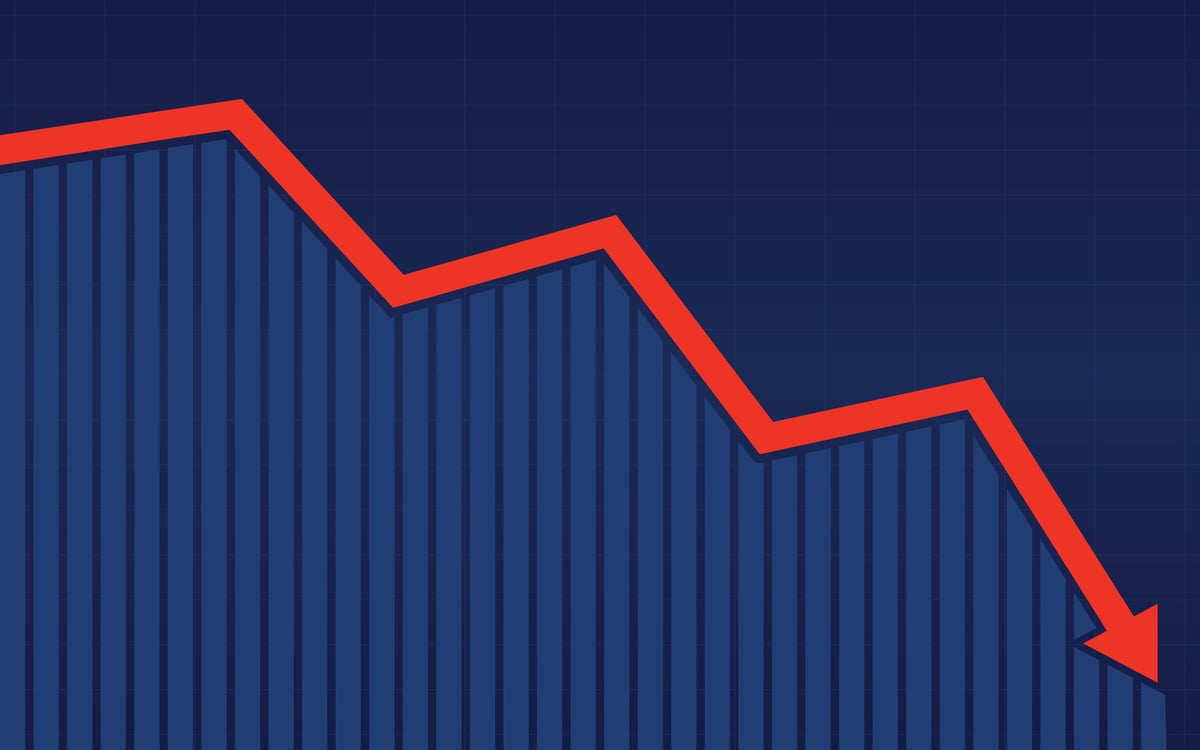

Down 73% From All-Time High, Is The Trade Desk Stock a Buy?

12/26/2025 06:31 PM • The Trade Desk stock has plummeted 73% from its all-time high, though the underlying business remains solid with 18% year-over-year revenue growth and strong profitability (43% EBITDA margin). However, growth is decelerating from prior quarters, and the stock still trades at a premium 44 P/E ratio compared to the S&P 500's 26. The analyst suggests waiting for either a $30 price target or evidence of growth reacceleration before buying.

TTD - While the company demonstrates solid fundamentals with strong profitability (16% net margin, 43% EBITDA margin), 95%+ customer retention, and continued revenue growth (18% YoY), the stock faces headwinds from decelerating growth (from 25% in Q1 to 13% expected in Q4), a premium valuation (44 P/E vs S&P 500's 26), and management's admission of Q4 2024 underperformance. The analyst remains on the sidelines, suggesting the risk-reward is not yet favorable.

Investing.com • Chris Markoch

Investing.com • Chris Markoch